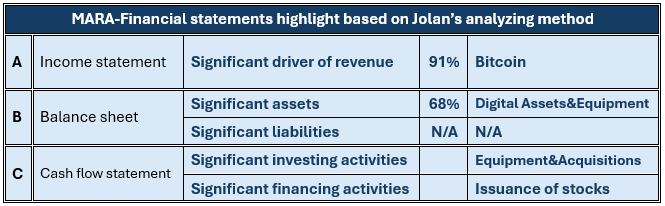

Fundamental analysis of the 2nd quarter of 2024 financial report

Introduction:

Marathon Digital Holdings Inc. (MARA) is an American-based company and is a global leader in digital asset computing especially in Bitcoin mining. From 2021, MARA’s owners have insisted on an optimistic and long-term vision of Bitcoin. Regardless of the negative margins in some periods and the weak performance of Bitcoin after the 2024 halving, increasing digital assets, producing and holding policy, and acquisitions of the new mining sites through raising capital reveal the managers’ determination.

- Significant driver of revenue: Bitcoin

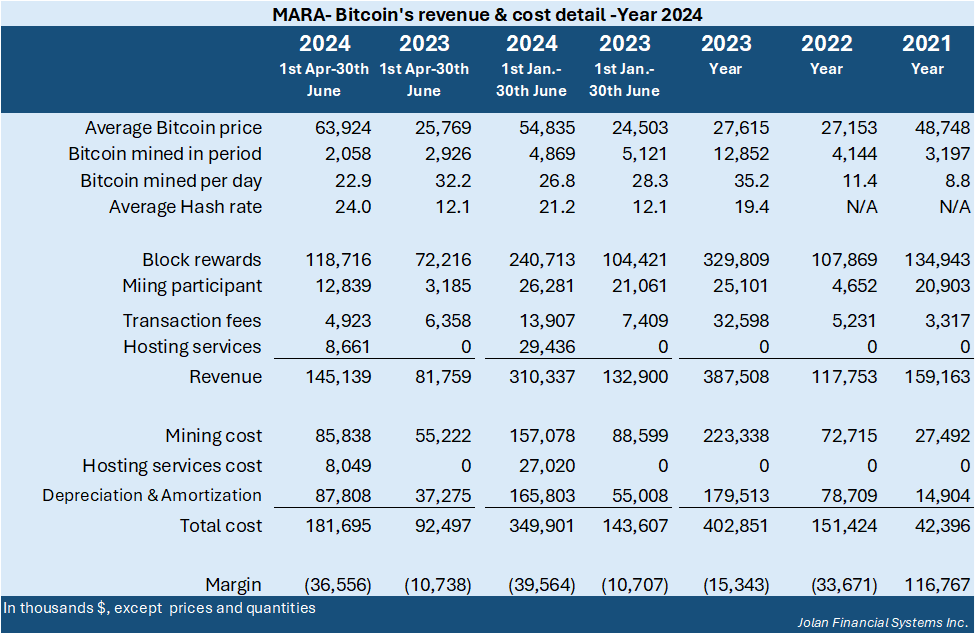

The fact is, Bitcoin income faces fears and hopes, both in the present and future.

A.1 Challenges of the halving

The 2024 halving event occurred on April 19, 2024, and decreased the reward of each successful validation of a block from 6.25 to 3.125 Bitcoin. This has adversely impacted the company’s ongoing revenue and profitability. However, theoretically – which has been confirmed historically – the halving event due to a reduction by half in supply will cause a price boom and compensate for it. But as seen on the chart below, 5 months after the 2024 halving, compared to the previous events in 2016 and 2020, there is no significant short-term movement in the price of Bitcoin. Therefore, the long-term direction of Bitcoin price will be very influential.

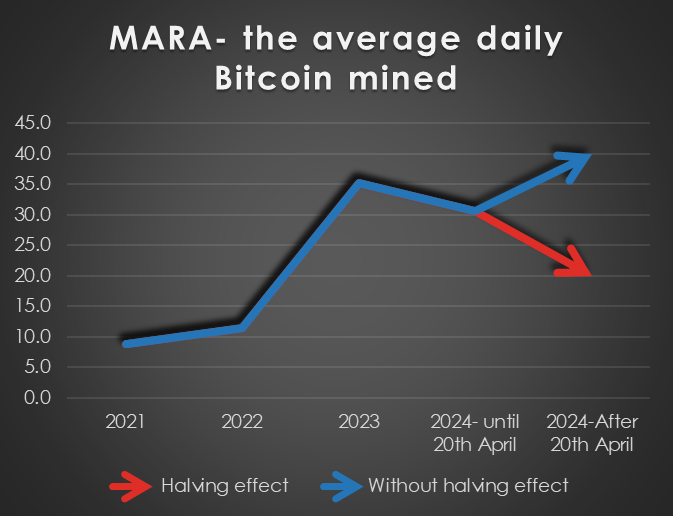

A.2 The mining performance problem

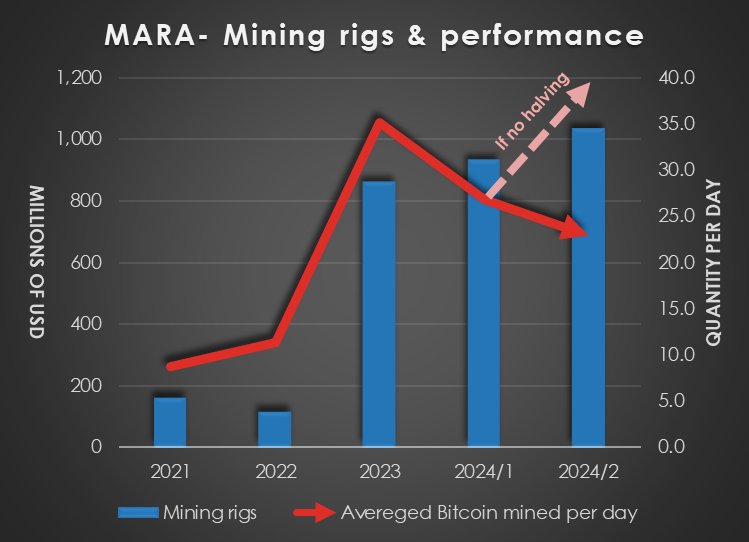

Based on the latest quarterly report, up to June 30, 2024, not only the halving has damaged the company revenue, but there is a real sign of a decrease in the block rewards in the first quarter this year (before the halving event on April 20, 2024). In this quarter, the daily mined Bitcoin declined to 31, compared to the average of 35.2 in 2023, due to the increased global hash rate and the continued impact of unexpected equipment failures, as the company declared in the report (P. 40). In the second quarter, after acquisitions of new operational Bitcoin mining sites, the daily mined Bitcoin increased to about 40, although the halving event decreased it again to nearly 20 Bitcoin per day. Despite the much higher average price of Bitcoin compared to 2023, these two parameters, i.e. the halving effect and low mining performance, have caused the margin to not go out of negative numbers.

A3. What will be going on in the rest of 2024?

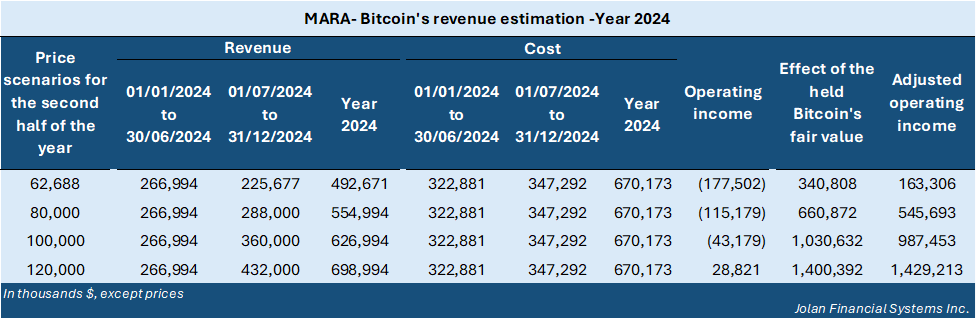

Estimation of Bitcoin income based on different price scenarios:

The price of Bitcoin on June 30, 2024, was at $62,688. According to an optimistic scenario, a doubling of the price ($120,000) caused by a halving of the supply may increase the company’s revenue and lead to much higher profitability, to the extent that it compensates for all past losses. Pessimistically, the other scenario is that the price stagnates at the level of the third quarter of 2024, which will spoil the company’s investment efforts. As shown in the table below, the impact of the held bitcoin (in the long-term assets) will be highly vital.

B. Significant assets:

B. Significant assets:B.1 Digital assets: Shifting to a long-term vision

In 2024, looking optimistically at the future of Bitcoin, MARA changed its strategy; Bitcoin has been moved from the current assets side to the long-term ones. “The Company is primarily focused on computing for and holding digital assets as a long-term investment. Bitcoin is seeing increasing adoption, and due to its limited supply, the Company believes it offers an opportunity for appreciation in value and long-term growth prospects for its business.” (10-Q: Quarterly report published on August 1, 2024, P 7).

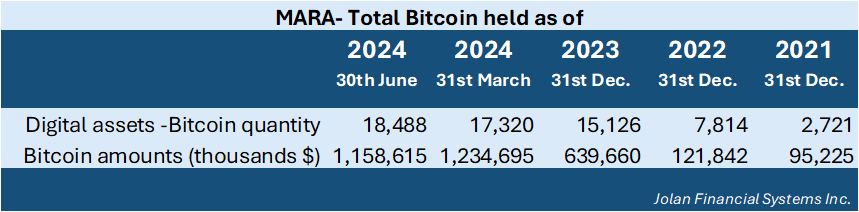

Apart from the above, MARA has continuously increased Bitcoin’s balance. The table below demonstrates that from 2021, the Bitcoin assets in the Balance Sheet have increased year by year, from 2,721 Bitcoin in 2021 to 18,488 Bitcoin on 30th June 2024, which completely reflects the long-term vision of MARA’s managers on the optimistic aspect of Bitcoin in future.

B.2 Property and equipment: The effort to increase the production capacity:

Due to the increase in the global hash rate and the halving event, Bitcoin miners must constantly upgrade their production capacity and mining rigs. Up to 2023 and in anticipation of the halving event, MARA has increased the equipment by 6 times (compared to 2021), especially through new mining sites acquisition. Now the book value of this equipment is more than $1B. However, as can be seen in the chart below, Bitcoin mined per day decreased despite the equipment upgrades.

C. Financing activities:

Constant flow of the capital injection

All the above expenditures, i.e. equipment, acquisition, and long-term maintenance of digital assets require money. For financing, the company is persistently attracting and increasing capital, and investors of very high risks in this market continue to inject money. Additional paid-in capital has boosted from $835m to $3,073m, despite the continued accumulated losses, humble and with a long-term view. “The Company expects to have sufficient liquidity, including cash on hand and access to public capital markets to support ongoing operations. The Company will continue to seek to fund its business activities, and especially its growth opportunities, through the public capital markets, primarily through periodic equity issuances using its at-the-market facilities” (10-Q: Quarterly report published on August 1, 2024, P 44).