Introduction:

The essential nature of the banking industry is having long-term assets versus short-term liabilities. In a situation of economic prosperity and stability in which the long-term values dominate the short-term ones and everyone looks at the distant but attainable horizons of profitability, the banking industry is happy and would be the winner sector. When the economy gets in trouble, as the instability of the bank liabilities disturbs the consistency of the bank assets, immediate liquidation, and the deposit rescue will become more important, as everyone forgets any long-term values. Especially in intensive inflation, when the banking sector is disordered by increasing interest rates, although a rise in the loan interest rate may boost long-term income, it would not be responsive to the stress caused by depositors as a very short-term liability. The fact is bankers are always welcoming the decreasing or at least stability of the interest rates.

This analysis explains how the increase in the interest rates disarranged the peace of the Royal Bank of Canada, the biggest bank in Canada and one of the largest in the world.

A. Analysis of the Interest rates challenge:

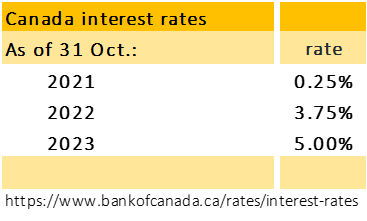

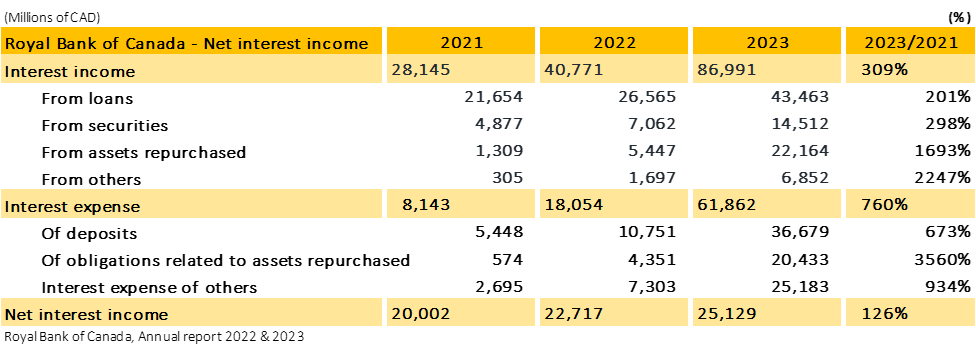

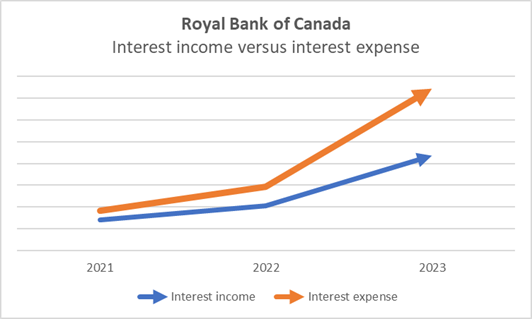

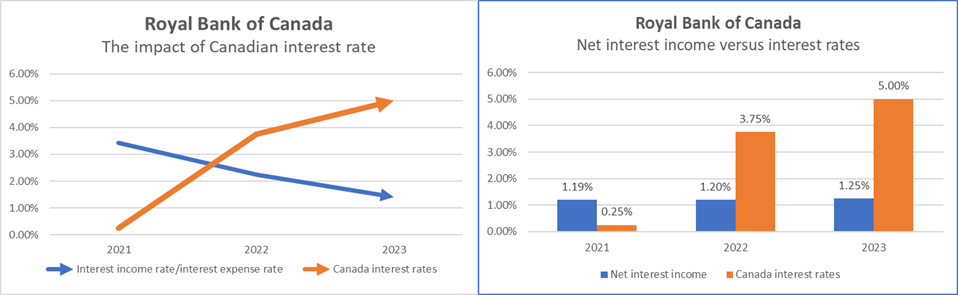

Regarding income statement figures for 2021 to 2023, at a glance, there aren’t any signs of an undesirable situation. Interest income is growing and profitability continues, but ratios show something else, while interest income increased by 309%, the interest expense boom roared to 760%, therefore Net Interest Income (NII) rose just 126%. This simply indicated that in the situation of increasing interest rates, expenses rise more than incomes.

In addition, the other figures illustrate that the ratio of the mainstream of the bank income that is loan income, significantly declined. While the interest income from loans has been just twice in the period, the interest expense from deposits has boosted up to 673%. The amount of fixed-rate loans at about $610B (71%) could be a serious reason for the low scale of the loan interest income growth. The below table, i.e. NII based on the balance sheet amounts/percentage figures of income statements, also shows a significant increase in the expense rate.

Currently, the net Interest Income is still positive, but with the above 5% interest rate continuing in 2024-25, the Interest Income Margin (NIM) may be threatened. The deposit interest amount is the most significant item of the interest expense, as it is related to the biggest liability in the balance sheet. Besides, the increase in interest income of the securities and assets purchased and repurchased is about offset by the liability’s corresponding amounts. Moreover, the subordinated debt cost has sharply boosted, but the amount of this debt is not very effective in the financial position of RBC.

Furthermore, the charts below demonstrate that the bank’s NII rate (and also NIM) has been sharply overcome by the Canadian interest rate. It is very clear that because of the post-pandemic situation as well as the political instability and conflicts in Europe, the Canadian government under the classical principles of economics, had to raise interest rates to combat intensive inflation which has been predominant throughout the world too.

B. Beyond the interest rates – the positive side of the bank performance:

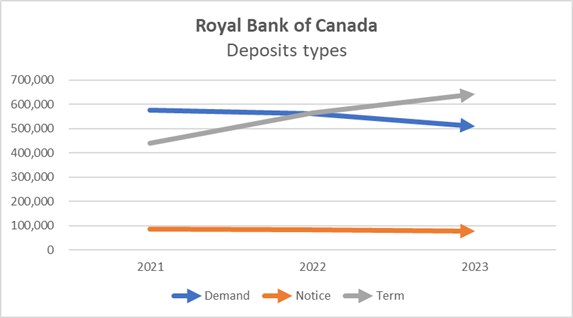

Diversification: loans have been paid to many different sectors and businesses. Depositors came from many different kinds, persons, businesses, and governments. The securities are from diversified sources, although most of them remained in the type of governmental ones ($268B about 65% of the total securities). Compared with Silicon Valley Bank, a US bankrupted bank in 2023, in which most of the securities were HTM and long-term ones, loans have been mostly paid to a special class of customers; to large startup businesses, the depositors were the same business, often demand and notice deposits, and mostly the amounts were more than $250k and uninsured.

Non-interest income and expense both remained in reasonable trend: This indicates the Bank’s stability and organizational control power against inflation and relative economic unrest.

Increasing the term deposit amounts versus the demand deposits: In the conditions of increasing interest rates and inflation, there is a reasonable expectation that the amount of term deposits will decrease because depositors expect higher rates in the near future, so keeping money at a fixed rate will not be a logical decision. Despite this, Royal Bank has managed to increase term deposits. This is thanks to the higher yields that the bank offers to customers, although this has increased the interest costs, but led to a stabilization of the bank’s financial position. A glance at the balance sheet shows that the demand deposits ($510B) could be offset by cash and the current portion of loans & and securities ($519B). The chart of deposit types demonstrates the issue.

C. Interest rates estimation- macroeconomics trend effects

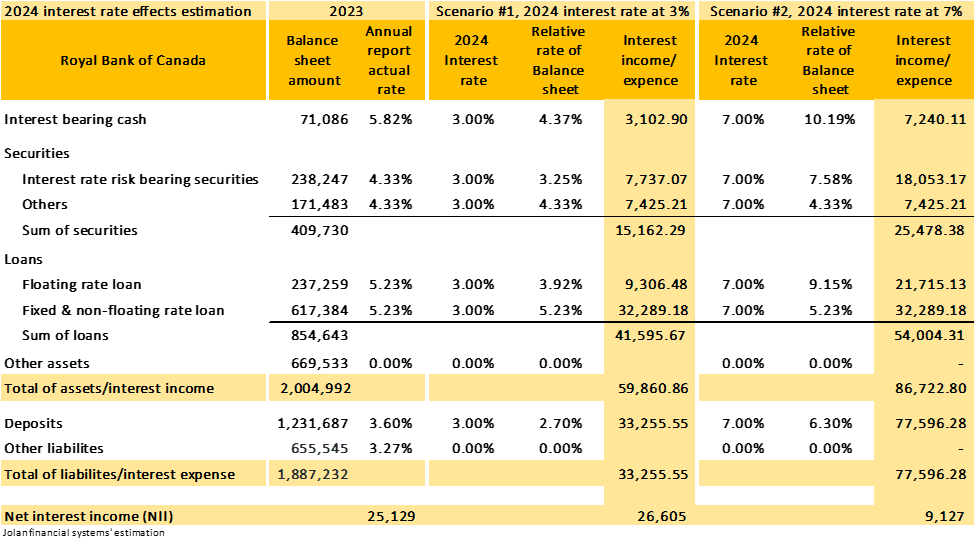

Currently, the most important macroeconomic parameter that may affect the banking industry is the interest rate. The table below assumes two different scenarios for interest rates in 2024; an optimistic forecast for declining rates to 3%, and a pessimistic forecast for boosting rates up to 7%. By considering material items of the RBC balance sheet, i.e. cash, securities, loans, and deposits, the impact of interest rates on the other items of the balance sheet was neglected.

The figures indicate that by the 7% interest rate assumption, the net interest income drastically decreases to $9,127B, and by 3%, it slightly rises and reaches $26,605B.

In the pessimistic estimation, adding the historical non-interest income/non-interest expense trend, the bank’s profitability might be a minimal amount. However, because of the above-mentioned parameters, the bank’s financial structure will remain steady and firm.

Jolan Financial Systems Inc.