by Hassan Keshavarz

Financial analyst at Jolan Financial Systems Inc. A startup in BC, Canada

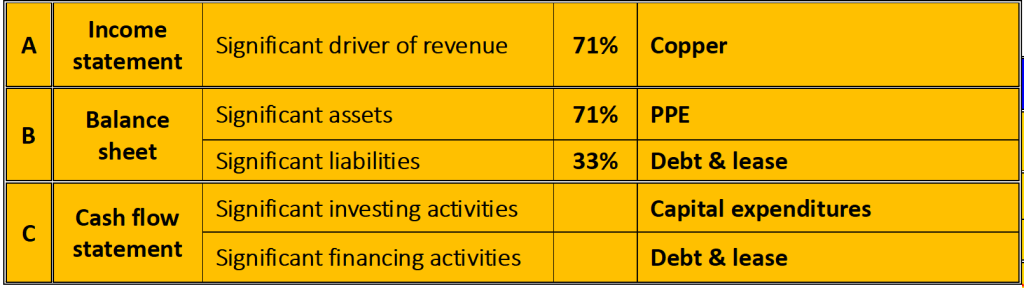

Financial statements highlight based on Jolan’s analyzing method

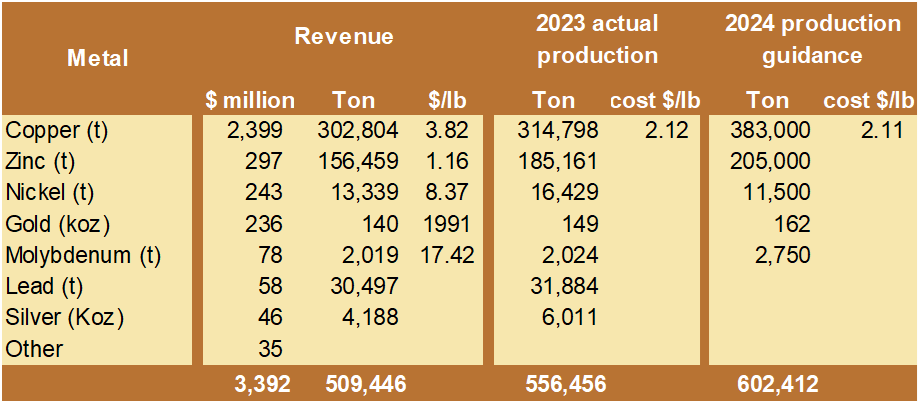

- Significant driver of the revenue: Copper

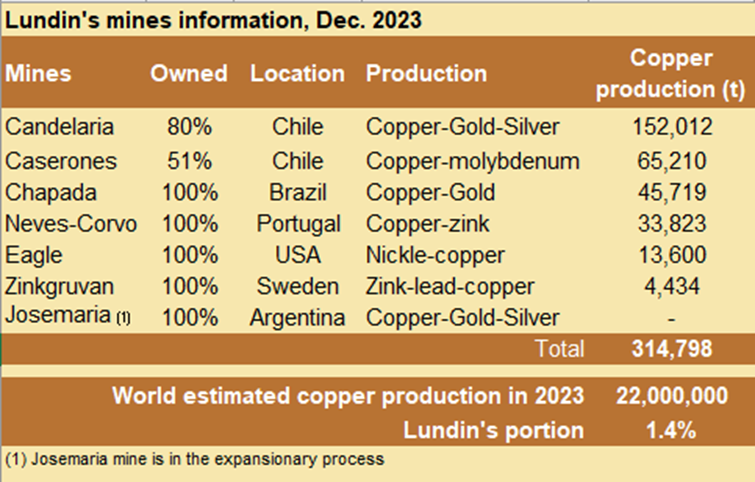

Copper is the greatest product of Lundin Mining Corporation. In 2023, $2,399 million of the company revenue came from copper, about 71%. This is probably why Lundin continues to acquire copper mines in Chile which has the world’s largest copper reserves. In 2023 they completed the acquisition of 51% of the equity of Minera Lumina Copper Chile, which owns the Caserones copper-molybdenum mine located in Chile. Now, Lundin seems to share 1.4% of the world’s copper production.

Also, Lundin started the Josemaria mine project in Argentina last year. The problem is although the recent investments will promote the company’s metal reserves and market share in the future, it will lead to a rise in new debt and the financing of capital expenditures. Especially, the Josemaria project which will be the main challenge of Lundin in the next years. While there is no possibility of a remarkable increase in production, the solution may be the price. Is there any hope for increasing copper prices? The global condition should be scrutinized.

A.1. The macroeconomic condition of copper

Copper, also known as Doctor copper!, is one of the most strategic metals in the world. In 2023, it seems that the copper demand and supply were in an equilibrium condition at about 22m tones. “Copper is the third most used metal in the world with Chile as its biggest producer and China as its biggest importer. The annual copper demand is expected to increase by 53% by 2040, mainly due to the electrification of vehicles. Global EV sales are expected to account for 40% of the total car sales by 2030. However, the world is looking at copper shortages in the near future. The copper inventories are near historical lows. On top of that, copper giants are expected to face production shortages in the future. Copper price saw its peak in April 2022 at about $10,000 per ton.” (https://finance.yahoo.com/news/15-biggest-copper-companies-world-132108207.html)

Besides the future demand of the electric cars industry for this strategic metal, the industries of equipment, construction, and infrastructure are the permanent consumers of copper and there are not any signs of demand reducing in the long term. In the short term, China’s recession as the largest consumer of copper may threaten the copper market. The global copper price at the end of the first quarter of 2024 has reached $4/Ib and in April soared to $4.4/lb which has been higher than the 2023 average price. Ideally, a considerable increase in the price could help the company to cover 2024 financing costs and cash flow requirements.

A.2. Copper cost & revenue

In the table below, the revenue and production of copper and all other metal of the Lundin mines has been provided. The company hope to increase copper production up to 22% in 2024, which is not too ambitious regarding the newly acquired mine that is Caserones.

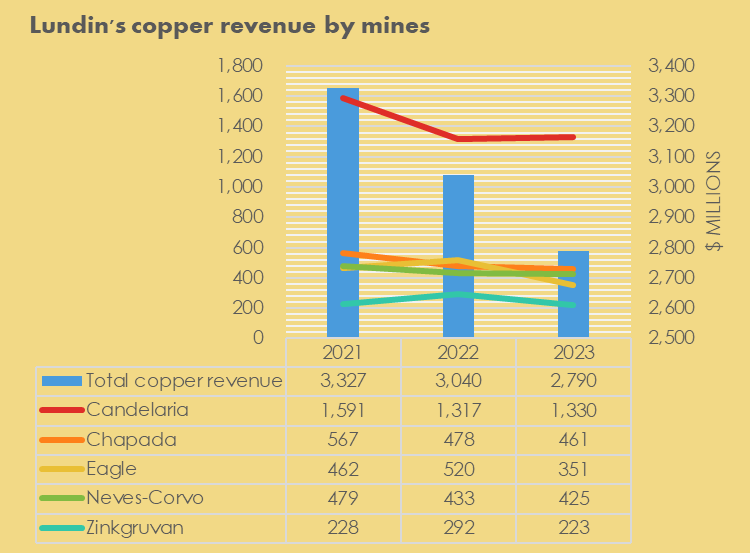

In fact, as per the table below, If the Caserones are not considered, the company’s total copper revenue have a declining trend from 2021 to 2023. The Lundin copper production has also decreased, 262,884t for 2021, 249,659t for 2022, and 249,588t for 2023. Therefore maybe the new mine salvage Lundin’s copper performance. Due to the downward trend of copper price in the mentioned period, the revenue decline has been more remarkable than the production ones.

About costs, in 2023 the cash cost has been 2.12 $/lb, while AISC (All-in sustaining costs per pound) has been at 3.34 $/lb. This non-GAAP measure which includes cash cost plus elements such as sustaining capital expenditures, royalties, reclamation, other closure accretion, lease, and others was 3.22 $/lb in 2022 and 2.52 $/lb in 2021 which indicates that the copper production cost of Lundin has increased more than the sales price trend. However, all of them are still below the realized average copper price of 2023 sales which has been 3.82 $/lb.

B. Significant items of balance sheet

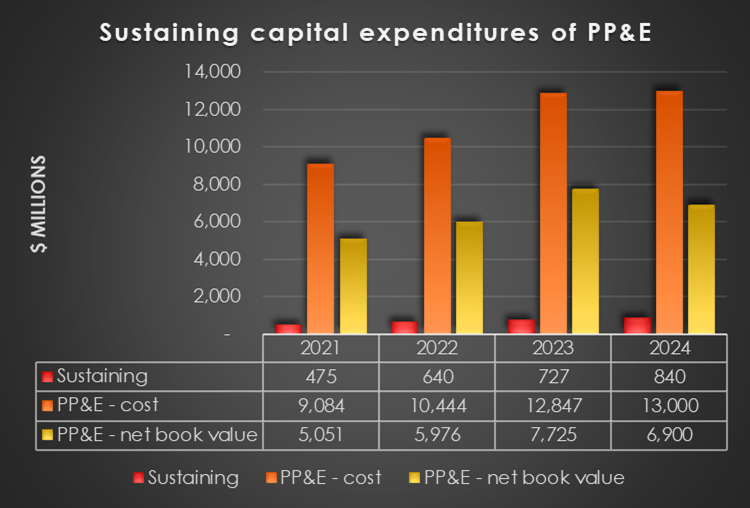

B.1. PP&E. The most important asset of a mining company is the mineral properties, plant and equipment (PP&E). The table below indicates that the sustaining expenses in capital expenditures has been about 6%. This may be implied on the company steady performance in PP&E maintenance.

For 2024 figures, the sustaining amount comes from Lundin forecasts in the 2023 financial report and the PP&E cost/net book value figures are the article estimations.

B.2. Financing and debt

Debt and lease liabilities (current & long-term) have boosted from $31m in 2021 to $1,485m in 2023 as the investing activities has increased from $520m to $1,674m in the same period. In these years, the company have been engaging in risks, hoping the new acquisition and investment to expand the production and revenue.

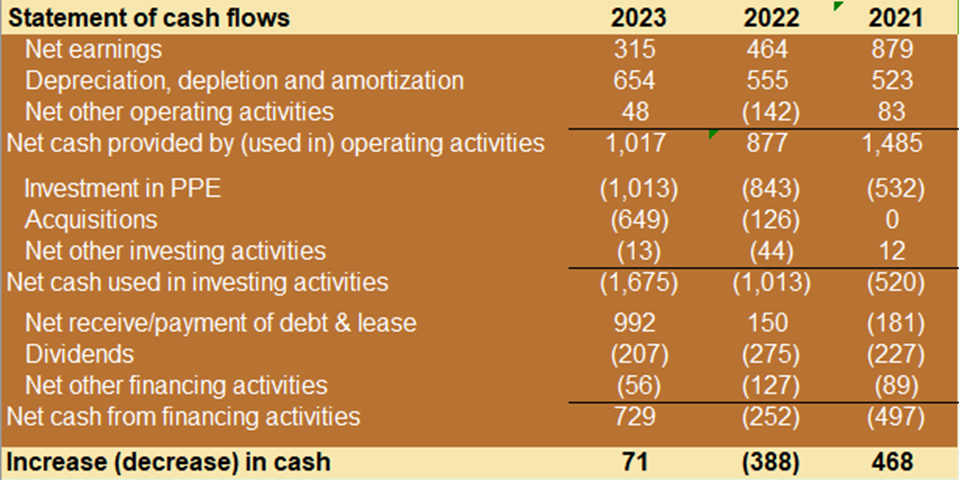

C. Significant items of the cash flow

From 2021 to 2023, the net cash provided by operating activities has declined, mainly because of decreasing net earnings. Despite 2022, the company’s cash has not been adequate for investing activities therefore Lundin have to rise new debt to finance new acquisition in 2023. For 2024 too, although there would not probably be a new investment, but to finance the capital expenditures and especially Josemaria project expenses, they have to engage more financing activities. The finance cost in 2024 will be the highest one comparing the recent years.