by Hassan Keshavarz,

Financial analyst at Jolan Financial Systems Inc. A startup in BC, Canada

A. Introduction

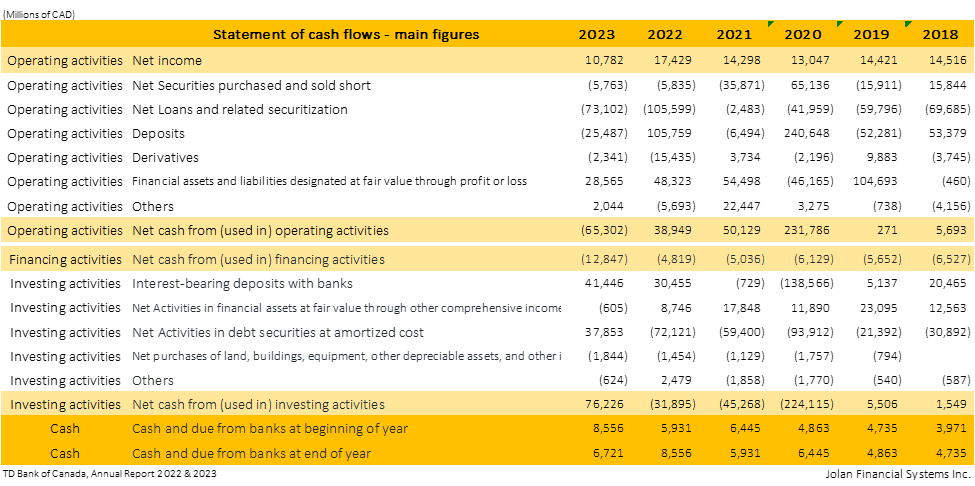

From 2018, this is the first time that the net cash flow from the operating activities has become negative in TD Bank. In such conditions, banks have two options to compensate for the deficit: financing through issuing new shares, bonds, and other capital instruments, or liquidating some of the invested money, technically speaking, banks need to deal with the matter by financing or investing activities. TD Bank chose the second option and decided to sell some of the invested short-term and long-term assets, which in turn is contrary to the direction of bank profit-making. On the other hand, realizing that the net income before tax has been the lowest since 2018 as well, shows that the bank has not been able to benefit from the higher interest rates in the inflation time. As described below, to deal with the liquidity risk the bank’s profitability will likely decrease in 2024.

B. Liquidity risk measurement

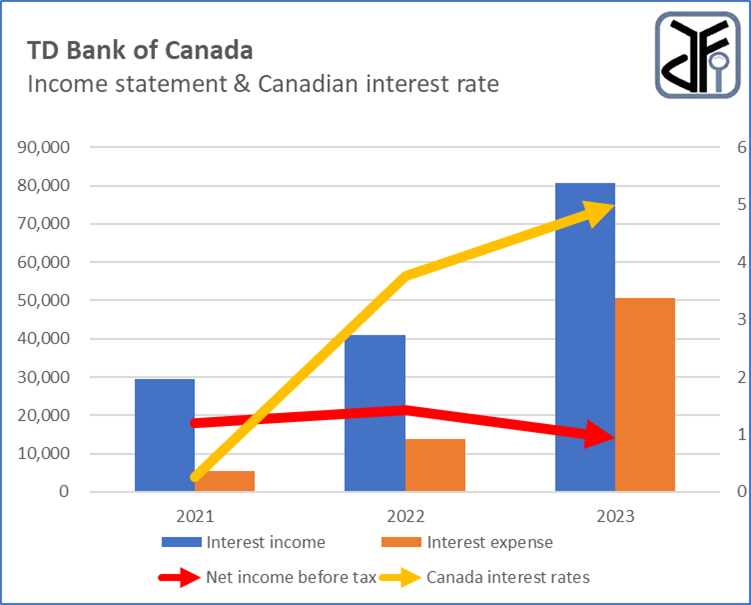

The negative amount of operating cash flows is the figure of CAD 65,302 million. It seems that the deficit has been caused by the payment of new loans and excess withdrawal of deposits. But comparing 2018 and 2023, the main reason is the decline of net income, despite almost 200% growth of interest income. The bank income interest has increased from CAD 27,790 million to CAD 80,674 million while the net income from operating activities decreased from CAD 14,516 million to CAD 10,782 million in this period. This is all because of boosting the interest rates and as a result, more acceleration in the increase of interest expenses.

To deal with the deficit, TD has withdrawn CAD 41,446 million from deposits with banks and also has sold a net amount of CAD 37,853 million of debt securities. The chart below demonstrates how cash flow from investing activities increased to compensate decline of operating activities, in the absence of any financing activities policy.

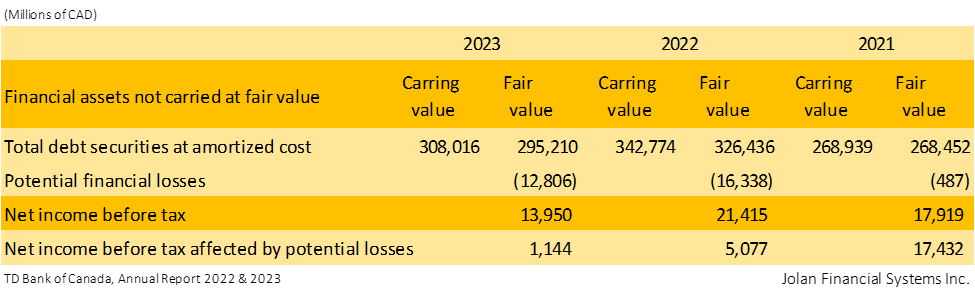

Nonetheless, while the interest rates are still rising, there is one risk in selling the debt securities at an amortized cost. Because this Held-to-Maturity type of debt securities may be losing part of their value, and as they are not carried at the fair value in the balance sheet, the loss might be hidden in the reports, as a result, the annual report might not disclose the clear situation of the entity. The fact is devaluation of the HTM securities does not appear until they are sold – remember the Silicon Valley Bank collapse.

However, the broadness of the TD assets and liabilities instruments makes the bank far enough from the poor SVB conditions. The table below shows the potential loss of selling all debt securities at amortized cost.

C. Liquidity based on interest rates risk measurement

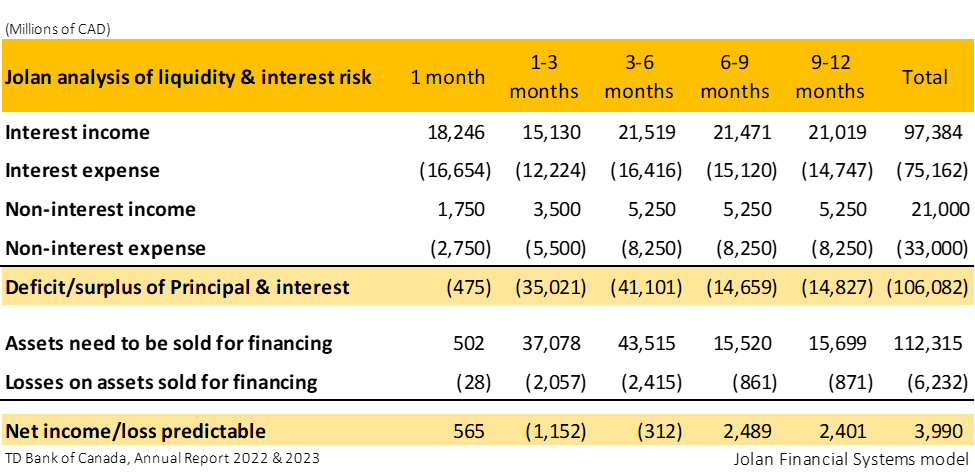

The table below analyzes the contractual maturities of TD assets and liabilities in 2023. To analyze the effect of interest rates on contractual settlements, the average interest rate of 2024 is estimated according to the Canadian government rate in 2024. As shown in the table, there will be a deficit in all months of 2024, so the operating cash flows and net income will probably decline as well.

Assumptions: Non-interest income of 2024, CAD 21,000 million estimated, non-interest expense of 2024, CAD 33,000 million estimated

Upon the interest rate and the fact that the expense of liabilities is still lower than the income of assets, the table below indicates that if the bank success in raising and attracting customer deposits, the cost of the financing will be slightly lower, and the net income will be higher, although, the condition still will not become better than 2023.

D. The profitability

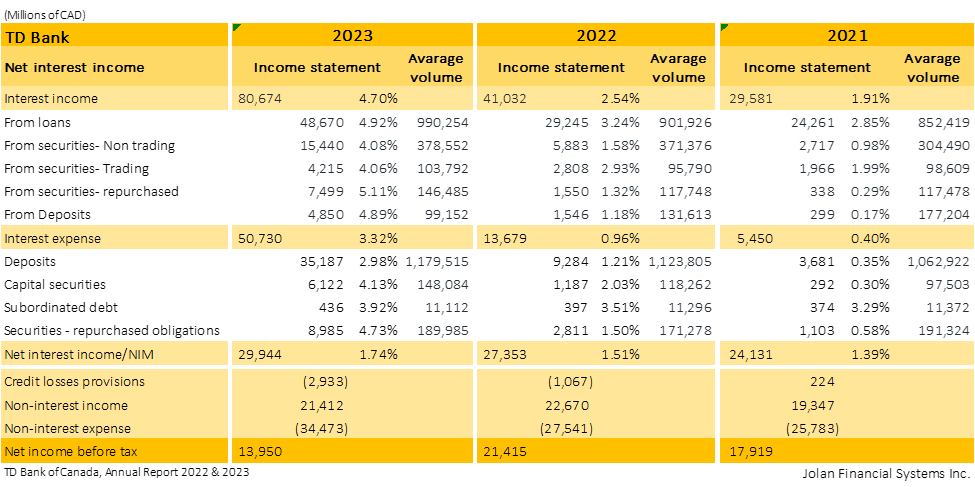

In the conditions of intensely boosting the interest rates in 2023, it seems that as much as the increase in interest expenses has suffered TD, it has not benefited from the rise in interest income. As shown in the below table, while the average interest expense rate was just 0.96%/0.40% in 2022/2021, the rate increased by 3.32% in 2023, comparing the average interest income rate which increased from 2.54% to just 4.70%, less than double. Regarding other incomes and expenses, this caused to decline in the net income to CAD 10,218 million, the lowest figure since 2018.

To summarize, if the rise in interest rates continues, the profitability of banks in 2024 will be probably weaker than in 2023.