June 6, 2025

Kinross Gold Corporation is a leading Canadian gold mining company with operations across multiple continents, including North America, Africa, and Latin America. We are going to review Kinross’s 2024 financial report.

Gold prices are rising, Concerns & Hopes for Kinross:

- Is Kinross ready to win, or at risk?

- Does Kinross have the resources to benefit?

1. Significant Driver of Revenue: Gold

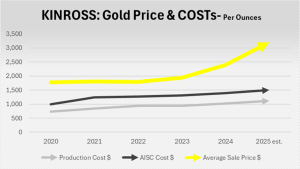

From 2020 to 2025, Kinross’s gold production has remained stable at approximately 2 million ounces per year. Operating cost and AISC (All-In Sustaining Cost) figures show only a moderate upward trend, indicating no major internal changes in mining efficiency or cost structure. The decisive factor lies beyond the mine gates: the gold price. If the current upward trajectory in gold prices continues, Kinross stands to benefit significantly. However, if gold prices stagnate or decline, the company’s profitability could be at risk, despite operational stability.

Tasiast in Mauritania remains Kinross’s largest and most cost-efficient mine, delivering the highest production at relatively lower costs. In contrast, the Great Bear project in Canada received a $150 million investment in 2024; however, production is not expected to commence until 2029.

2. Significant item of balance sheet’s Assets: PP&E

- Kinross holds over 21,800 Koz of proven and probable (P&P) reserves, positioning it as a mid-tier player with approximately 2% of global gold production in 2024. This resource base supports long-term operations, but effective capital allocation remains critical.

- From a financial structure perspective, PP&E accounts for nearly $8 billion in net book value—over 70% of total assets, in line with major gold peers like Newmont and Barrick. While this high asset concentration reflects operational scale, it also introduces liquidity risk if asset utilization or gold output declines.

3. Significant item of balance sheet’s Liabilities: Long-Term Debt

- Debt Dominance in 2023: Long-term debt was the largest liability (49%), but Kinross aggressively repaid it in 2024.

- 2024 Shift: Provisions and tax obligations now represent a larger share due to debt reduction.

- Improved Balance Sheet: Total liabilities dropped 14.5%, signaling stronger financial health.

- Lower Debt = Reduced Risk: Interest expenses fell, freeing cash flow for dividends/projects.

4. Significant Investing Activities of the Cash Flow Statement : Capital Expenditures

Kinross consistently shows the lowest Sustaining to PP&E and Sustaining to Cost ratios among its peers, indicating a more conservative approach to sustaining capital investments. While this may point to efficient asset utilization and disciplined capital management, it could also signal potential underinvestment in maintaining and extending the productive life of its assets. Striking the right balance will be essential to ensure long-term operational sustainability without compromising financial efficiency.

5. Significant Financing Activities of the Cash Flow Statement : Debt & Lease Repayment

- Debt Management: In 2023, Kinross undertook significant debt repayments totaling $960.0 million, partially offset by new debt issuances amounting to $600.0 million. In 2024, the company focused on reducing its term loan obligations, repaying $800.0 million.

- Shareholder Returns: Dividends remained consistent, with approximately $147 million paid to shareholders in both years.

- Interest Expenses: Interest payments decreased from $53.2 million in 2023 to $35.6 million in 2024, reflecting the company’s efforts to reduce debt.

Kinross 2023 analysis: https://www.linkedin.com/posts/hassan-keshavarz-89b998266_kinross-kgc-gold-activity-7206283352461447169-RMUD?utm_source=share&utm_medium=member_desktop&rcm=ACoAAEFJH_cButIB8PecC3zBcctMXtxrtLT264Y