Introduction: The importance of the banking industry in a financial analyzing software

The banks are the heart of the stock markets, especially in the North American markets. The collapse of Silicon Valley (SVB), Signature (SBNY), and First Republic Banks (FRB) raised fears for happening a new overall financial crisis like the 2008 ones. The fact is the crisis did not stop these banks, and the whole banking industry, especially in the USA, has been affected by the crisis, but authorities managed the crisis in any way.

The Jolan analysis will demonstrate that the crisis was not a kind of widespread and universal problem. The crisis just arose from mismanagement which led to an incorrect distribution of the bank’s assets and liabilities. The financial situation and the arrangement of securities and deposits of these three banks did not match the new macroeconomic parameters, or vice versa; the Fed regulators and decision makers were not sufficiently aware of the decision consequences like hovering interest rates in the case of the banking industry.

As a financial analyzer software, there is no difference between them. No matter whose fault it was. The models must be constructed in a way to detect diversions from the company’s financial reports and reevaluate financial positions as soon as macroeconomic changes occur, and finally, aware investors in the stock markets.

Focusing on the content of this writing, the financial statements of the banking industry and, at the same time, its analysis models are the most complicated compared to the others. Here, the recent American banking crisis has been analyzed from the perspective of Jolan’s software method.

The core specifications of the model

Industry oriented

- Preparation of the financial statements in the same and comparable formats according to the different industries.

- Separation of the financial analysis models and ratios according to the different industries.

Features oriented

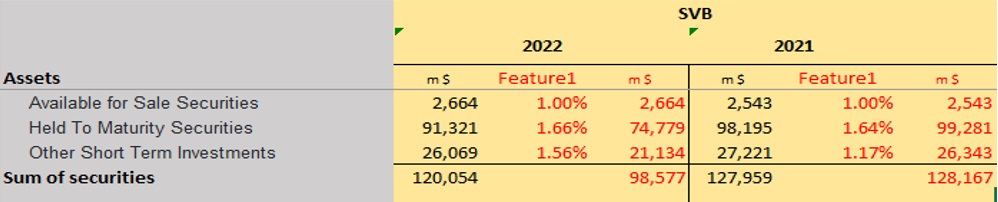

- Traditionally method of providing financial statements does not sufficient for the Jolan method of analyzing. Jolan assigns appropriate features/characteristics to every item of financial statements.

- For instance, the account of securities in the balance sheet would have different interpretations based on which features are considered. Features like available for sales /held to maturity, valuation methods at fair value/at amortized cost, bearing/nonbearing interest…

Focusing on the interpretation of accompanying notes

- “The accompanying notes are the integral and inseparable part of the financial statements”. We always read this phrase in the reports. Jolan produces a new framework for financial statements which are somehow integrated with accompanying notes in a single table.

- Investors would be informed or maybe alarmed by the accompanying note’s effects.

Monitoring of the macroeconomic variables

- Automatic monitoring of the macroeconomic variables and updating stock analyses accordingly.

- Financial statement items may interpret differently in different macroeconomic circumstances. The FED interest rate affects seriously the financial analysis of the banking sector.

Expanding Jolan’s model on the current banking crisis

First, to better understand of the issue, the financial statements of the above three bankrupt banks have been compared with 4 large-and small-scale banks in Canada and the differences have been scrutinized. The selected Canadian banks are Royal Bank (RY), Bank of Nova Scotia (BNS), Laurentian Bank (LB), and National Bank (NA).

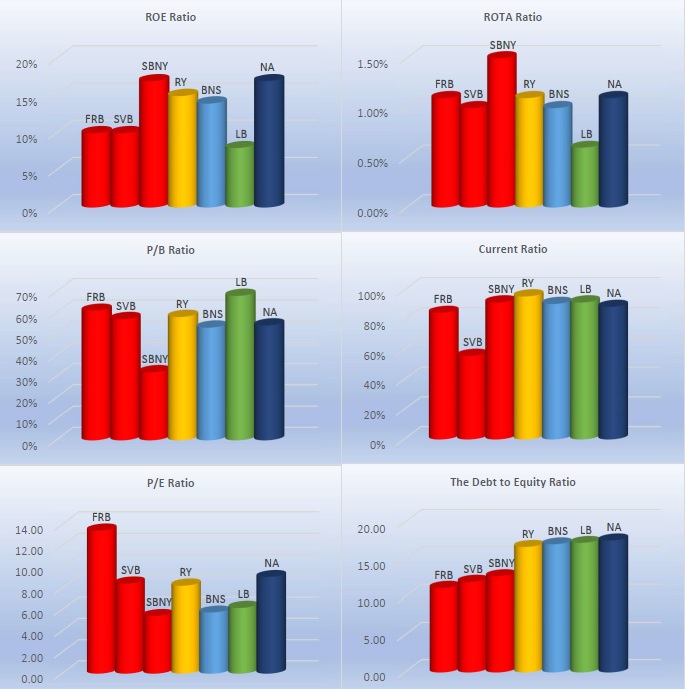

To begin the analysis, generally speaking, there are two main groups of analyzing ratios: Common ratios and Banking specific industry ratios.

Common (general) ratios:

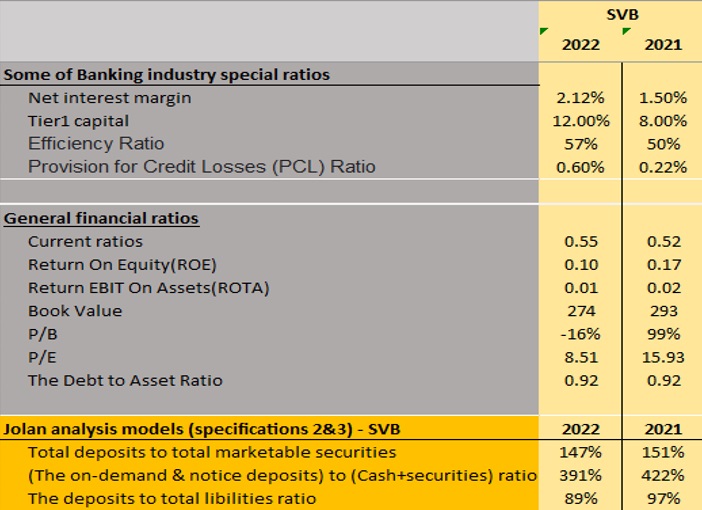

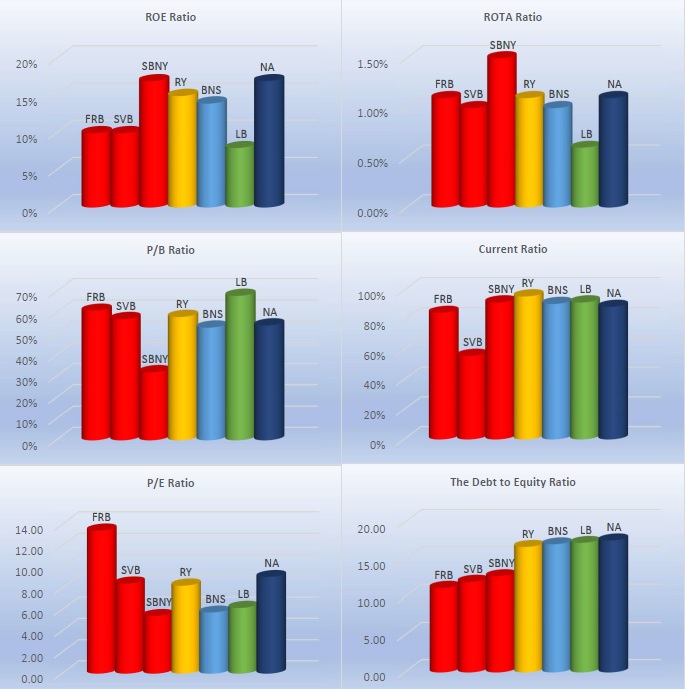

In the below charts, some common ratios were selected and calculated for the banks. As can be seen from the diagrams, considering the common ratios of the 7 banks at the end of 2022, there aren’t any considerable and critical differences between the 3 bankrupt banks and the stable banking system of the Canadian ones.

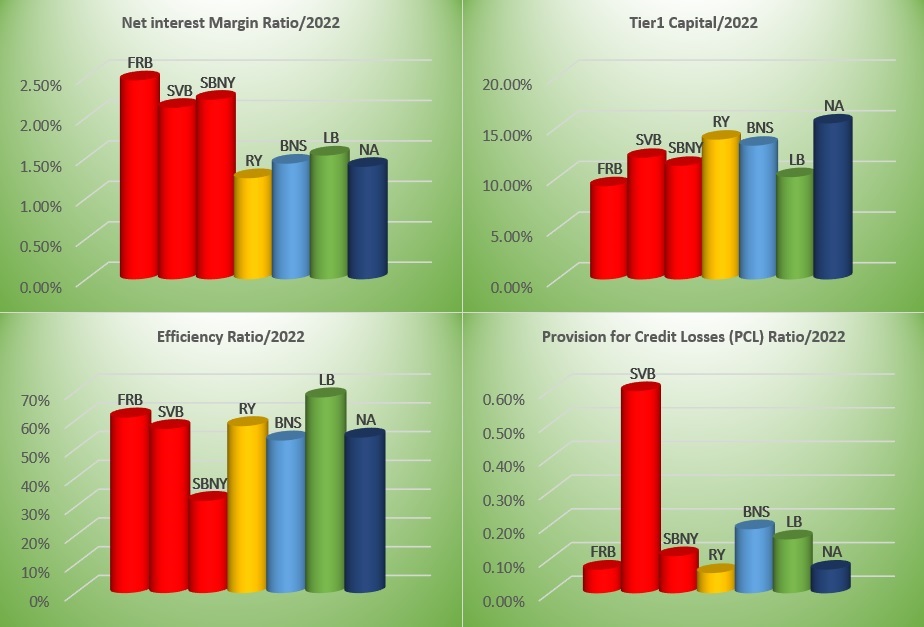

Banking industry-specific ratios (Specification No.1):

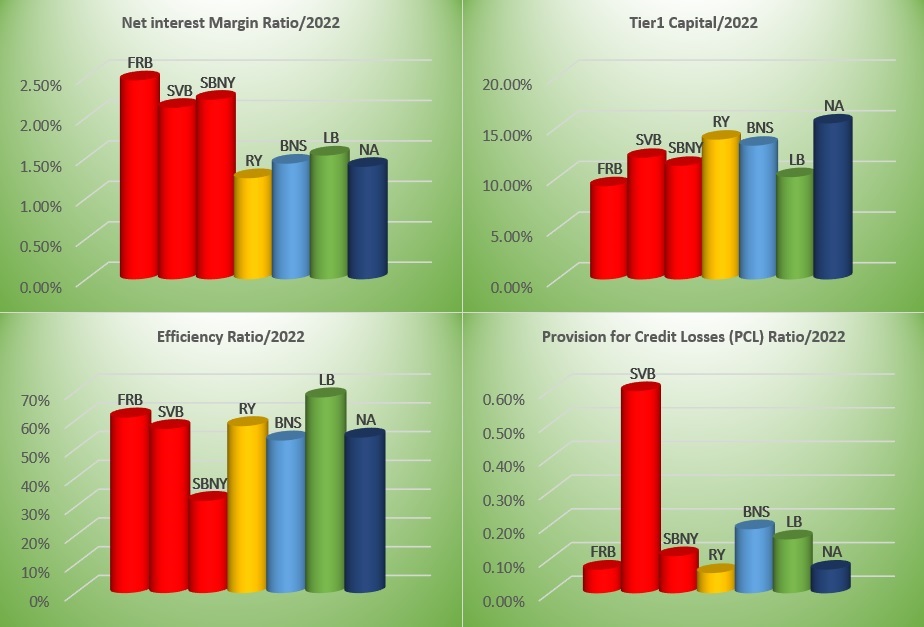

In the below-selected banking-specific ratios diagrams, the differences between banks have become more apparent, but although there are some signs of problems in the banking special ratios, still no serious alarm could be detected. The net interest margin of the 3 banks is higher than the Canadian banks, thanks to the bolder policy of the bankrupt banks, while they have weaker points in the minimum capital coverage regulations. Because they are banking in venture and risky industries like startups and cryptocurrency traders.

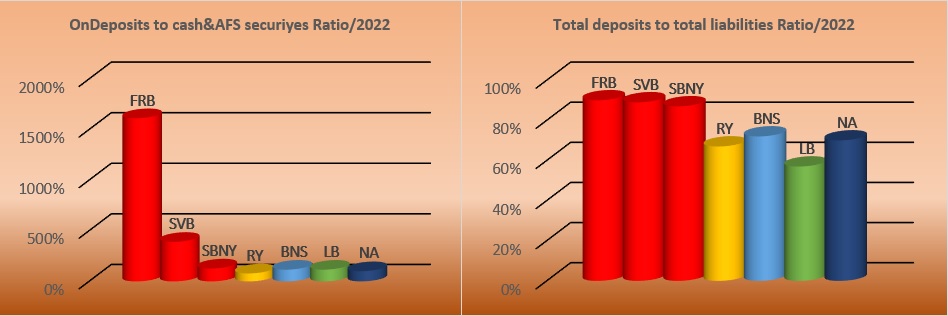

Applying other features of assets and liabilities included in accompanying notes (Specifications No.2&3):

From the Jolan point of view, and referring to the feature-based model, putting ratios just on balance sheet items without considering the accompanying notes would not be an accurate analysis. For instance, securities and deposits have different features that just one of them may be inserted in the balance sheet, the others must be disclosed in the accompanying notes.

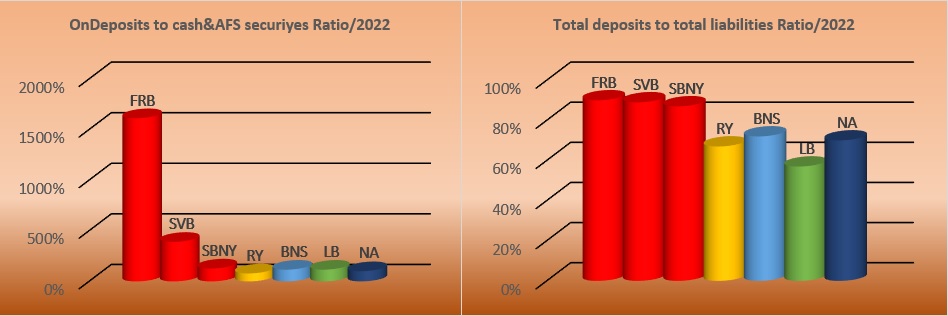

When the model selects the securities and deposits ratio based on liquidity possibility feature, the terrible differences between the 3 bankrupt banks and the 4 stable banks will appear. The ratio of deposits to securities based on this feature for First Republic is 1613%, SVB is 391%, and Signature is 128%, while this ratio for the 4 Canadian banks is from 79% to 116%!

On the other hand, the more deposits/liabilities ratio of the bankrupt banks means that their activities have not been diversified and all the eggs were in just one basket.

The analysis indicates that the bankrupt banks had less power to face the influx of depositors.

Also, regarding the contractual maturities of assets and liabilities disclosed in the accompanying notes, another drastic difference will come out.

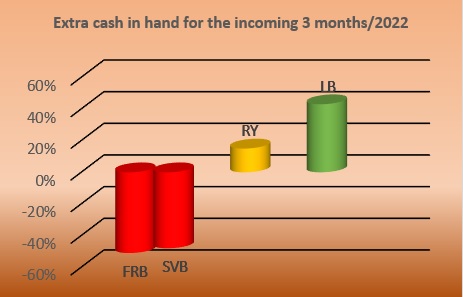

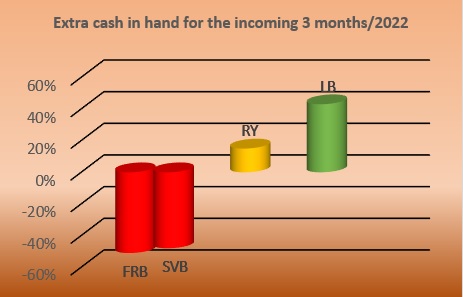

For a 3 months period after the end of December 2022, the Canadian bank would have extra cash in hand, or in other words the excess of assets over liabilities up to 43% while First Republic and SVB have a deficit of around 50%! (There is not enough minimum information to calculate this variable in SBNY, BNS, NA).

Monitoring the macroeconomic variables (Specification No.4)

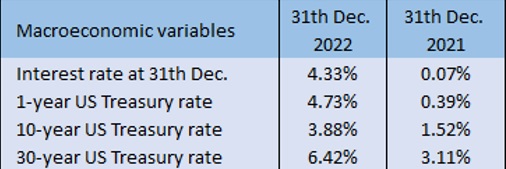

A critical question: Someone may ask, despite applying the model, there are not any significant differences between the 2022 and 2021 situation of SVB. Why didn’t the collapse occur in 2021?

As a matter of fact, in 2021, most of the yields/rates, the structure, and the proportion of securities and deposits were the same or even worse than in 2022. For instance, the 2021 rate of total deposits to total marketable securities was 151% while the rate is 147% in 2022. In 2021, SVB was more vulnerable against cautious depositors. So, the question is well reasonable.

To answer the question, the fourth and final feature of Jolan will be discussed. Jolan, through applying the macroeconomic variables, demonstrates how systematic risks have affected the financial position of SVB.

In 2022, to combat inflation, the Federal Reserve increased steadily the US treasury rates and interest rates, and the banking industry as financial and monetary-based institutions is always the first sector that is affected by FED decisions.

However, before the analyzers and specialists, the market instinctively reacted to these changes with a delay. Here, Jolan with a reevaluation of the bank assets and liabilities under new rates will explain the reaction and why investors rushed to withdraw their money in a few days. Briefly, after devoting an interest rate feature to the balance sheet items and then recalculating the NPV value of SVB securities based on the new 10-year US Treasury rates will find out that about $21 billion of SVB $117 billion securities will decrease in value! almost 10% of the total assets.

Two proofs to confirm the validity of the Jolan model

– On March 8 and before the collapse, to provide enough money in order to respond to the large evading number of deposits, SVB sold $21 billion in securities for a loss of $1.8 billion, about 10%.

– The current price of SVB stock indicates of the accuracy of Jolan’s computations. Assuming the official SVB equity’s value is at the amount of $16 billion, the book value must be around $266, while the stock is trading at the price of a few cents now. This is a sign that the market has regarded the effect of the SVB securities devaluation and has considered the equity value to be zero.

The conclusion

Financial statements and their accompanying notes will be the core of the Jolan software systems. Jolan claims that it could be able to explain fundamentally the banking crisis just according to financial reports of banks without any other tools. In a long-term prospective, a fundamental instrument could merely help investors to predict deviations in the financial position of the most complicated industry of the stock markets.