A. Introduction

Generally, banks receive money from depositors (at a lower interest rate) and lend it to borrowers (at a higher interest rate). There are always the people who have extra money to invest in the short-term from one side and on the other, the ones who need these money. Banks as a mediator do for both of them and make a profit in this way. In this sense, banks seem to be low-risk entities, but in reality, the story is not as simple as this, because the loan is a long-term asset and the borrowers are supposed to repay money just on a contractual maturity, while the deposits are a short-term liability and the depositors may need to withdraw the cash at once. Therefore, banks must hold part of the received deposits into other shapes of assets, i.e., other than loans, to be prepared to compensate for short-term withdrawals. That’s why banks maintain a portion of the deposits as cash, interest-bearing cash, securities, and different financial instruments. Besides, banks need to make money from these financial instrument activities, to regain the lost loan interest income.

The correct asset allocation is the art of banks, in which healthy cash flows, the depositors’ requirements, profitability, and solvency are respected.

B. Is there any assets allocation problem in Laurentian Bank of Canada?

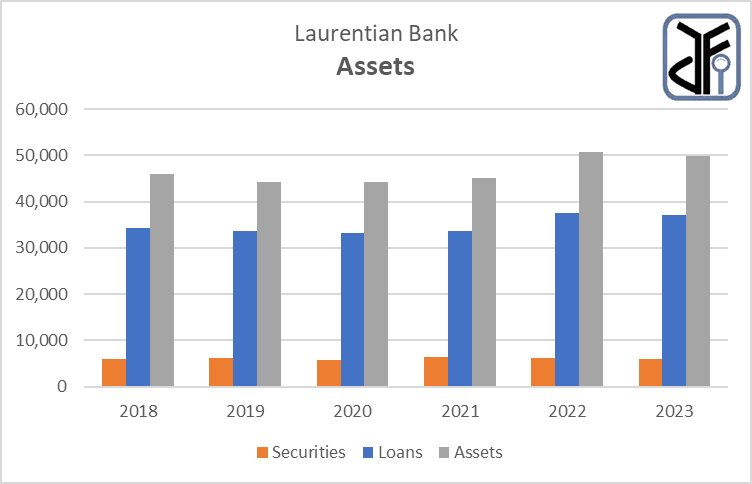

On 31st Oct. 2023, the loan amount is CAD 37,059 million, about 74% of whole assets, while the average for banks is within 50%. On the other hand, the securities amount is CAD 6,016 million, which is 12% of assets, while the banking sector average is usually more than 20%. In the same way, the interest income from the loan is the largest figure in the incomes (92%), while the portion of securities activities interest income is too low (4%) compared to the average banking industry.

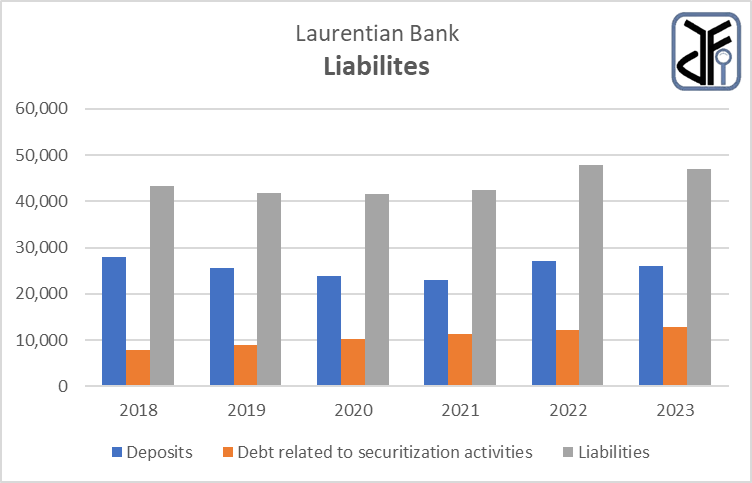

On the liability side, the deposits are 55% of total liabilities, and Laurentian Bank, historically, to more funding has resorted to “Debt related to securitization activities”, although based on the characteristics of this instrument, that is, to create and securitize debt instruments specifically mortgage-backed loans, most of this resource is dedicated to new loans paid during years. The below charts indicate that as “Debt related to securitization activities” increase, the loans rise and no money has not devoted to securities.

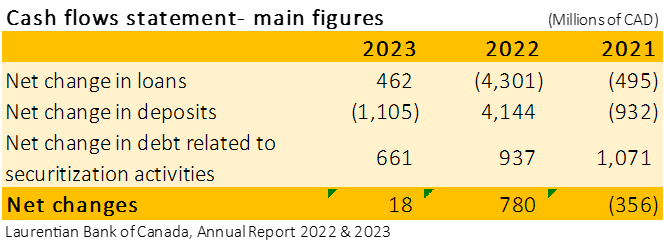

In other ways, the figures extracted from the cash flow statement (the table below) indicate that the consequence of the net changes in these three numbers is almost insignificant. It can be said that Loans, deposits, and debt related to securitization activities have played the main role in bank transactions over the years.

All of these demonstrate that the bank’s main focus has been on loan activities so far, while securities and other financial instruments have not been large enough to have a significant impact on the bank. To summarize, this may be due to a problem with asset allocation and perhaps that’s why there is no sign of a remarkable increase in the bank assets during 2018-2023, as there is not a notable improvement in equity in the same period either.

C. The profitability

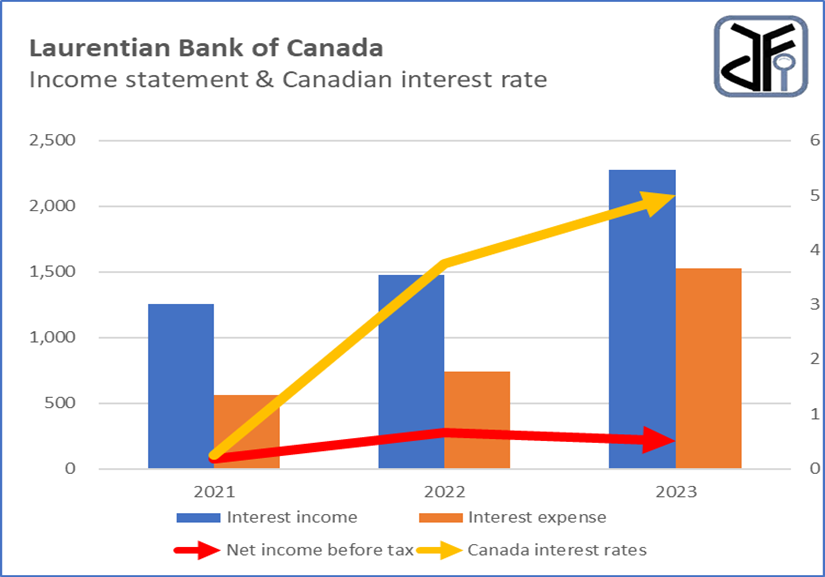

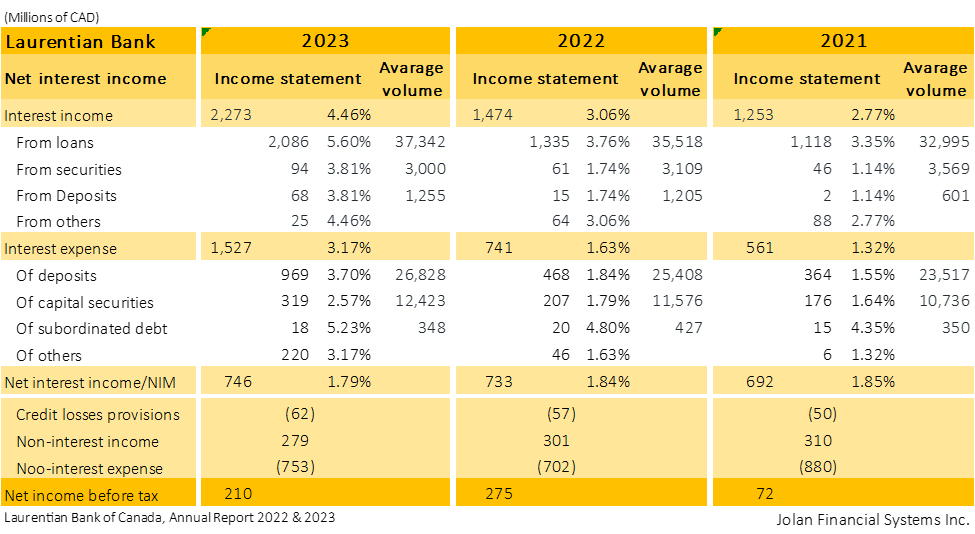

According to the following table, in 2023, though the interest income has reached more than CAD 2,000 million, the Net Interest Income not only proportionately boosted but also declined compared to 2022. Therefore, the impact of the interest expense rate has been greater than the interest income rate. This is all because of the government’s rising interest rates.

Besides these, the interest income of securities has a very low portion of the bank income. This is because of the low portion of FVTPL-type securities (about 50%) and the low scale of securities activity of the bank as well, as described in the previous part.

Regarding interest expenses, the Bank has been able to manage expense rates below the income rates. Notably the term deposits amount is about 67% of the total deposits and the demand deposits are just 4%, so this has helped management to control the deposit withdrawal. On the other hand, it needs to be added that the interest rate of the notice demand deposits (3.31%) unexpectedly is almost equal to the term deposits rate (3.78%). From a point of view, although the assets side might be in an ineffective allocation, liabilities have a better allocation, thanks to debt related to securitization activities the average interest paid is lower than the deposit cost. This kind of debt instrument has been a cost-effective long-term facility for the bank.

Finally, the structure of Laurentian Bank is still stable, but to improve more, needs to adopt a different strategy for asset allocation. Otherwise, further advancement in financial health and profitability is not expected.

Jolan Financial Systems Inc.

One Response

Useful information