by Hassan Keshavarz

Financial analyst at Jolan Financial Systems Inc. A startup in BC, Canada

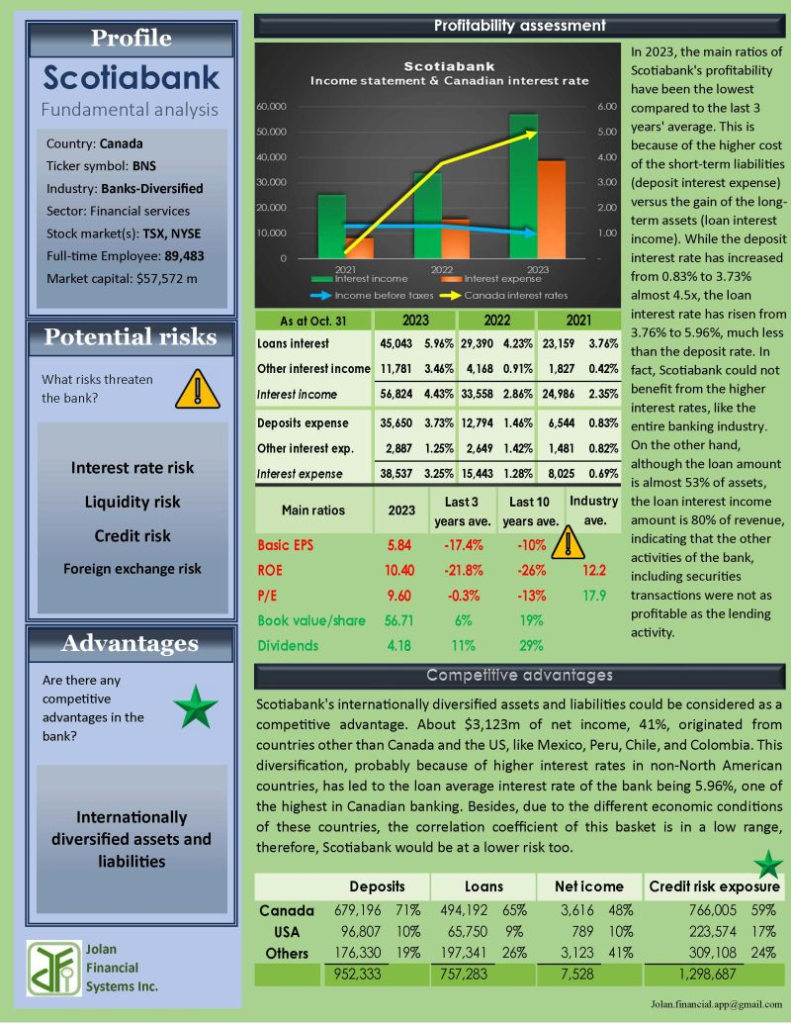

In 2023, the main ratios of Scotiabank’s profitability have been the lowest compared to the last 3 years’ average. This is because of the higher cost of the short-term liabilities (deposit interest expense) versus the gain of the long-term assets (loan interest income). While the deposit interest rate has increased from 0.83% to 3.73% almost 4.5x, the loan interest rate has risen from 3.76% to 5.96%, much less than the deposit rate. In fact, Scotiabank could not benefit from the higher interest rates, like the entire banking industry. On the other hand, although the loan amount is almost 53% of assets, the loan interest income amount is 80% of revenue, indicating that the other activities of the bank, including securities transactions were not as profitable as the lending activity.