by Hassan Keshavarz

Financial analyst at Jolan Financial Systems Inc. A startup in BC, Canada

Macroeconomic conditions of e-commerce platforms:

“The global B2C e-commerce market size was valued at USD 5,473 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 19.1% from 2024 to 2030” (Grandviewresearch.com). The e-commerce industry boomed internationally at the time of the Covid-19 pandemic and in the recent years, the dimensions and broadness of mobile phone facilities has fueled it. The Shopify’s market share in the US is about 10% and businesses and websites in more than 175 countries use this platform.

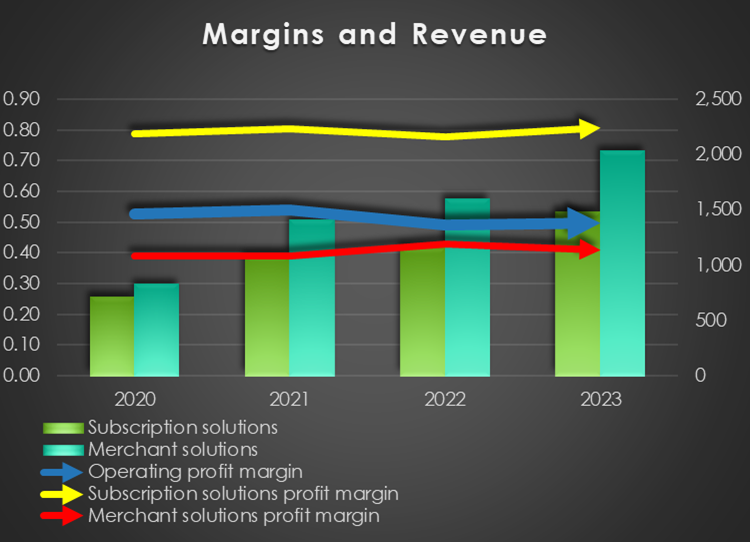

Profitability

The revenue is still growing up, from USD 1,578 million at 2019 to USD 7,060 million at 2023. The business model of Shopify consists of two main types, subscription solutions and merchants’ solutions. From 2019, the merchant solution revenue has increased more than subscription revenue, although the gross profit of subscription solutions has been considerably higher than the merchants’ solutions.

On the other hand, gross profit increase 28% comparing 2022, while the operating expenses has risen just 0.5% this means that with continuing the increasing trend of revenue, Shopify may be reached to profitability.

But what is the problem of Shopify net income? Establishing in 2013, the retained earnings is still negative and the gross profit did not afford the operating expenses. On the other side, the largest amount of the balance sheet items devoted to the securities activities which were not enough profitable in the recent years. Securities both short-term and long-term were USD 7,982 million, about 71% of the whole assets. The gain and loss of long-term securities originated from acquisition and sales of other companies share. In 2023, selling the stock of the Shopify logistics company incurred a loss of USD 1,340 million and the IPO of Klaviyo provided a gain of USD 1.5 billion. Looking at the figures for the long-term investments from 2019 to 2023, it can be seen that gains have often been offset by losses. Regarding the trading securities, they were not profitable enough because of the increasing interest rates. The company may need to revise investment policies.

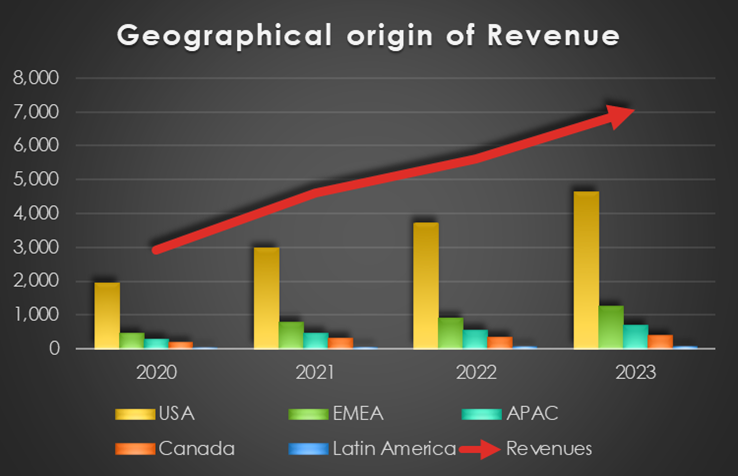

Geographical origin of revenue

Shopify established in Canada but currently 66% of the Shopify revenue origins from the US markets. As shown on the chart below, the Shopify revenue is growing constantly in all regions. More than 170 countries use Shopify solutions. Therefore, the geographical diversification of the company revenue would be considered as a positive fundamental element.

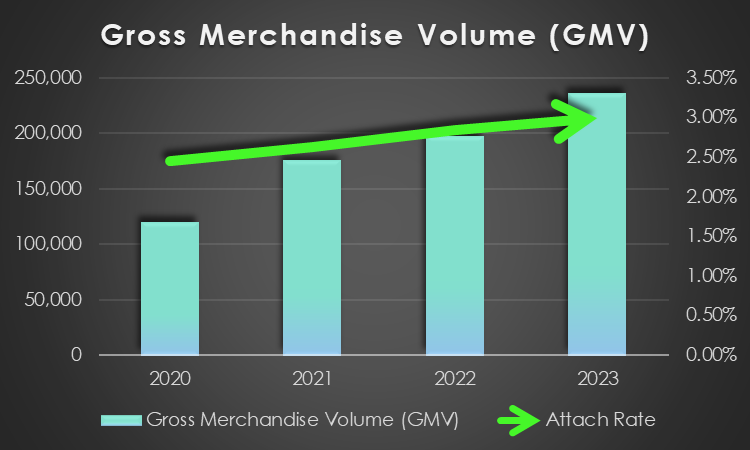

Gross merchandise volume

The B2C e-commerce platforms act as a mediator between businesses and customers. The scale of customers transactions indicates the domination of the platform and directly affect on the platform’s revenue. The Shopify GMV is growing year by year, thanks to both the global trend and enhancement of the Shopify ecosystem.

On the other hand, the Attach rate, a significant variable which indicates how much a platform could benefit from customers transactions was increasing too and about 3% at the end of 2023. See the chart above.