by Hassan Keshavarz

Financial analyst at Jolan Financial Systems Inc. A startup in BC, Canada

A. Introduction

In 2023, the net income of Bank of Montreal as well as ROA, ROE, and EPS have been the lowest compared to the last 10 years. Given these statistics and considering the rising interest rates- which have led to the relative shrinkage of the net interest income, BMO still insists on the dividend payout policy, more every year than last year, so that even the 2023 dividends have been more than the EPS.

B. The risk of profitability

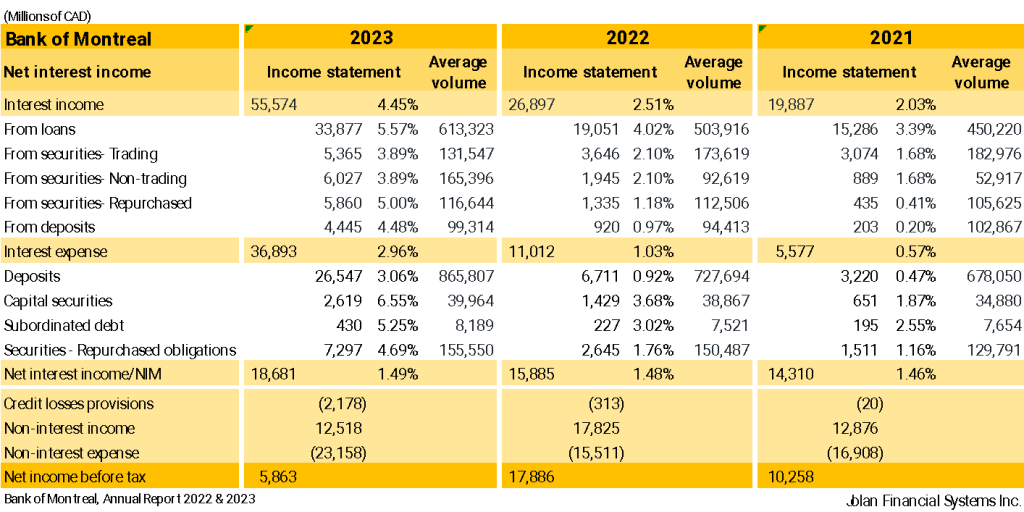

As with many other banks, for the sake of anti-inflation policies and high interest rates, the interest rates of expense have risen more intensely than the interest rates of income. This event has been slightly more severe for the Bank of Montreal because of the higher ratio of the BMO deposits to the total liabilities, about 70%. As shown in the table below, the deposit’s interest rate has increased from 0.92% to 3.06%. more than 3x, while the loan interest rate has risen from 4.05% to 5.57%, much less than the deposit rate.

In fact, despite doubling the loan income from 2021 to 2023, the net income has become half in the same period. It must be added that the boosting of the net income in 2022 was from the non-operating gain of the Bank of the West acquisition ($7,665 million) and it could not be regarded as a permanent income of BMO.

B. The risk of liquidity

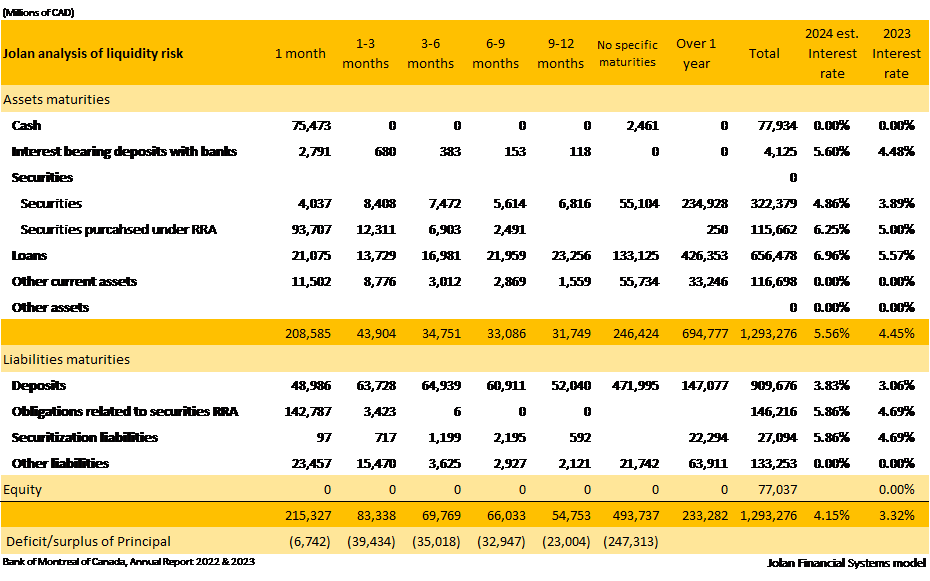

In the situation of negative cash flows, to continue to raise the new loans, BMO has attracted more deposits to compensate for the deficit. From 2021, $ 136,063 million in new deposits have been added to bank commitments (including $91,711 million in the deposits of Bank of the West which was acquired in 2023). Yes, this is a normal function of a bank; accepting deposits and granting loans, but with the expensive cost of liabilities along with the negative figures of assets and liabilities from the point of view of the contractual maturities throughout the 2024 fiscal year, this might have resulted in a more expensive financing to deal with the probable deposits withdrawal.

In the table below, the contractual maturities of the balance sheet figures indicate the current portion of assets and liabilities will be in a deficit of $ 137,145 million, and considering the no-specific maturities the deficit will amount to $ 384,458 million. This determines that if the deposits, especially the no-specific term ones, outflow remarkedly overtakes the inflow, BMO has to sacrifice the bank profitability to keep the bank liquidity, for the sake of the more financing cost. Meanwhile, as explained earlier, even now the BMO ratio of deposits to liabilities is higher than in the banking industry, therefore the attraction of more deposits would lead to higher liquidity risk.

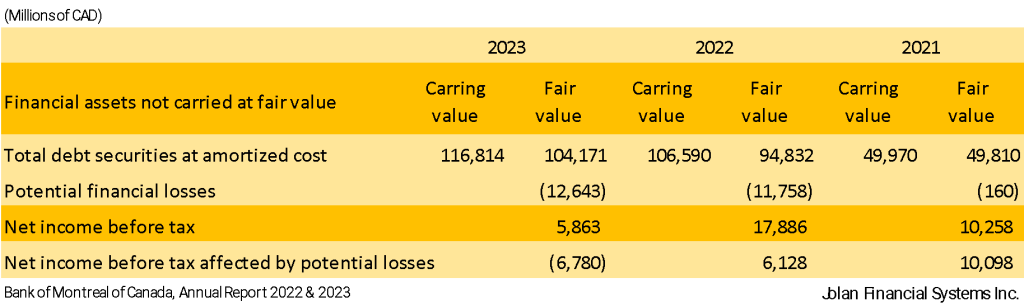

There is another risk in the BMO assets. According to the regulations, the debt securities are not carried at fair value in the balance sheet and they are recorded at amortized cost, the risk is if it needs to be sold to help liquidity, the Bank will suffer a loss because the fair value of the HTM securities declines in the higher interest rates condition. As shown in the table below, there is an amount of $12,643 million as a potential loss in this account. The realization of selling the debt securities might turn the profit into a significant loss for the Bank.

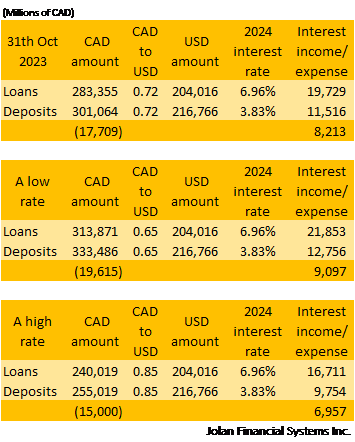

D. The risk of foreign exchange rate

The significant foreign exchange in the BMO assets and liabilities is the US dollar and the main items of the balance sheet that may be potentially affected by exchange rate fluctuations are loans and deposits, based on the Market Risk Disclosure (the 2023 Management’s Discussion and Analysis of BMO). As shown in the table above, the scale of related figures is almost equal, therefore the impact of the rate fluctuations, in a higher rate or lower rate, will be in a range that will not affect the BMO financial position dramatically.

……………………………………………………………………………………………………………………………………………

To summarize, while accepting the reality of the profitability risk, which is predominant throughout the banking industry too, the liquidity risk will not be very significant because of the combination of the BMO deposits, since the demand deposits are just $ 146,798 million (about 16% of total deposits) and the individual demand deposits are only $ 39,277 million (almost 4% of the total deposits). It must be added that the origin of the deposits is divided between Canada and the United States, as well as the loans case. In this way, the BMO assets and liabilities seem to be well diversified. Therefore, the bank is far enough from the excitement and panic of the retail depositors.