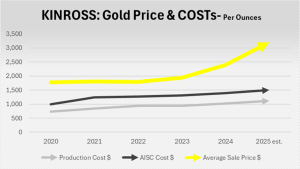

June 6, 2025 Kinross Gold Corporation is a leading Canadian gold mining company with operations across multiple continents, including North America, Africa, and Latin America. We are going to review Kinross’s 2024 financial report. Gold prices are rising, Concerns & Hopes for Kinross: 1. Significant Driver of Revenue: Gold From 2020