Royal Bank of Canada (RBC), Toronto Dominion (TD), Scotiabank (BNS), Bank of Montreal (BMO), and Laurentian Bank (LB)

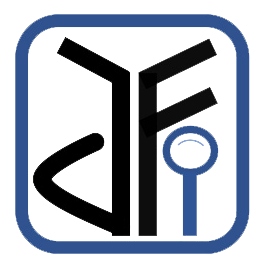

While the interest rates remain high and the banks’ profitability has declined, RBC and TD, above all other banks, continue to compete in the Canadian market, with a growth rate faster than the others. The following items have been reviewed:

– A three-year trend of interest income/interest expense rates

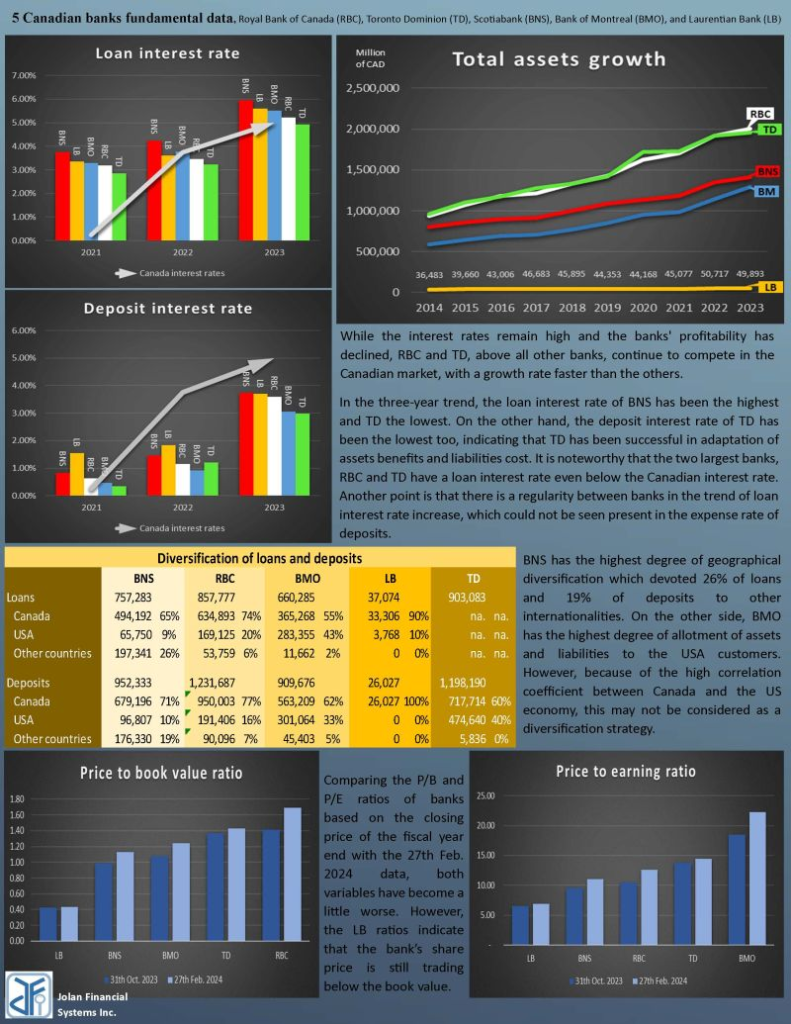

– HTM securities to assets ratio. This is a very significant variable, the collapse of Silicon Valley Bank was actually due to the disproportionate state of this ratio

– Geographical diversification of loans and deposits (actually customers)

– The banks’ management of assets and liabilities and ratios like loan-to-deposits and term deposits and, …

– A ten-year trend of banks’ asset growth and profitability including net income, dividends, ROE, and NIM

– Price-to-book value ratio and price-to-earning ratio

– Regulatory capital ratios

Jolan Financial Systems Inc.